Welcome to the official Wolfe Wave website as taught by Bill Wolfe. Please take a tour.

Very important: There are thousands of drawings on the Internet of “supposedly” Wolfe Waves.

They were not drawn by me and have no relationship to the precise rules that I teach.

(For recent SPECULATIONS please click: http://www.billwolfeswolfewave.com.)

Update: 3/25/24

Last chance to take my course for $2,500. After April 15th, 2024, the tuition for my course will increase to $3,500.

Update: 1/29/24

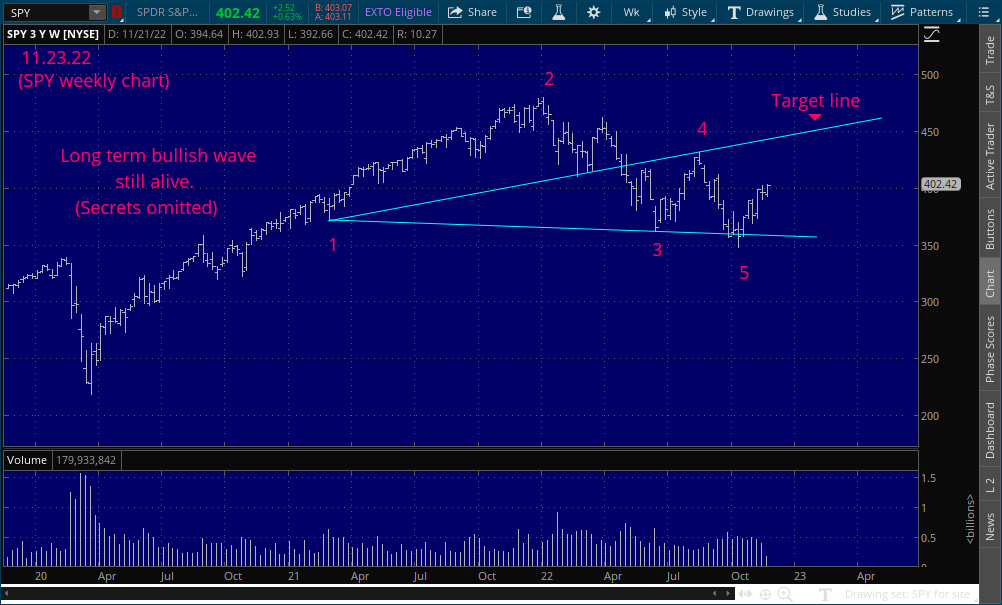

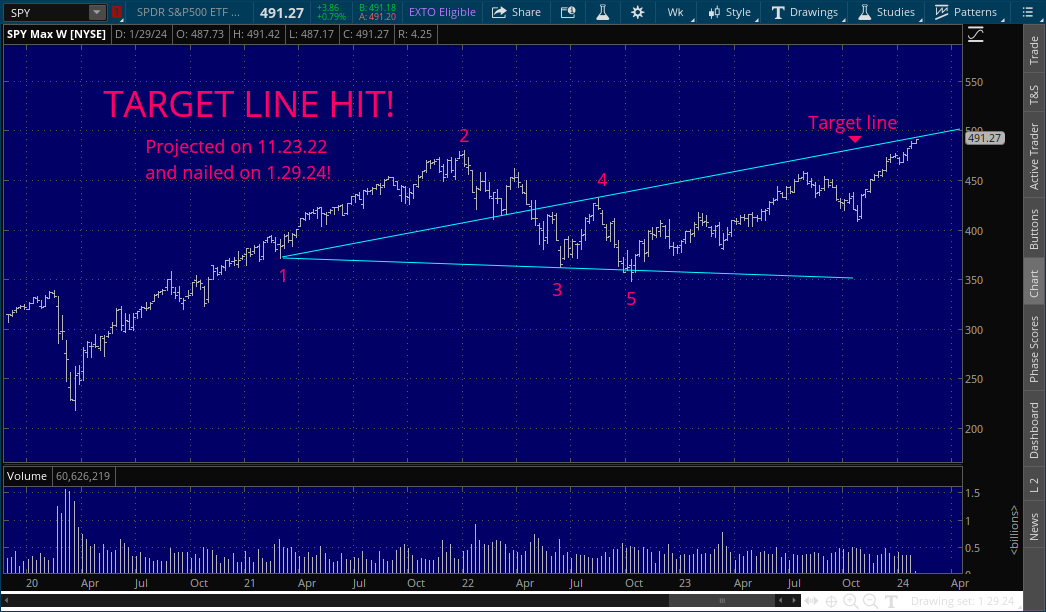

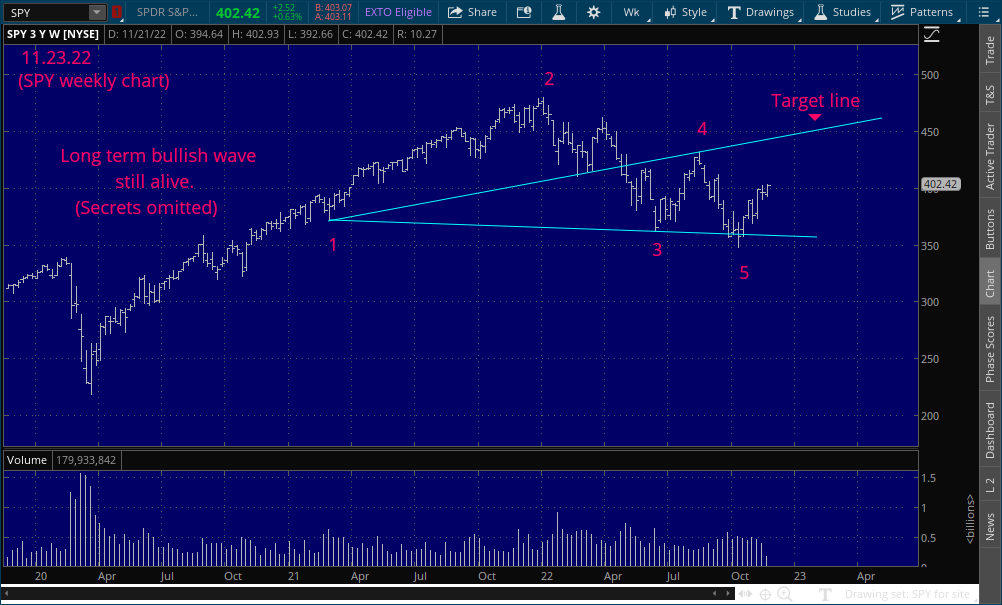

On 11.23.22, I projected that the SPY would hit this target line. (billwolfeswolfewave.com) Today, 1/29/24 that target was nailed (See second chart below).

I can teach you the secrets that can be applied to any instrument on any time frame

New price increase for 2024. On April 15th, 2024, the tuition for my course will increase to $3,500.

For those that join before April 15th, 2024, I will honor the special price that I posted in December of $2,500.

I have not yet decided when to start an option alert service that will be geared to lottery-like rewards by “betting” on very short-term options. Possibly 0DTE.

For those of you who did not take my Dec 4th teaching period, this is what you missed.

Email from student.

Hi Bill,

That was truly an incredible demonstration of how a Wolfe Wave transforms over time, with the Grand Finale today after the Fed announcement.

This “potential” ES bullish wave which was laid out Dec 4th had many lessons along the way which made for one of the best lessons ever, patience!

The target from the 5 point had a number of obstacles that were pointed out each day and are all in the manual and previous lesson for reference.

This particular wave was virtually an entire manual in one lesson and finally exploded today (Dec 13th ) to the extended original target line for a 125 point move.

Patience is a virtue and will be rewarded.

Thank you again, Bill.

12/14/23 (Canada)

Update: 12/11/23

Question: I am considering starting a put and call options alert service next year (2024). It would be for buying puts and calls. No writing options. Nothing fancy.

The focus would be on making extraordinary profits with the limited risk of the option cost.

Example: Buy XYZ call at 2 or better. Close at 10 or at expiration.

The recommendations would be based on Wolfe Wave analysis. If you may be interested in such a service, please send me an email.

Update: 11/10/23

Last call!

December 4th through the 15th will be my last teaching period this year.

Big discount!

For those that want to avoid a big price increase this is a special offer. I am offering a $500 discount for any that sign up for this last teaching period.

Price increase!

Next year there will be a substantial price increase as in addition to my advanced lessons I will be identifying potential lottery-like returns on specific put and call options.

Update: 9/26/23

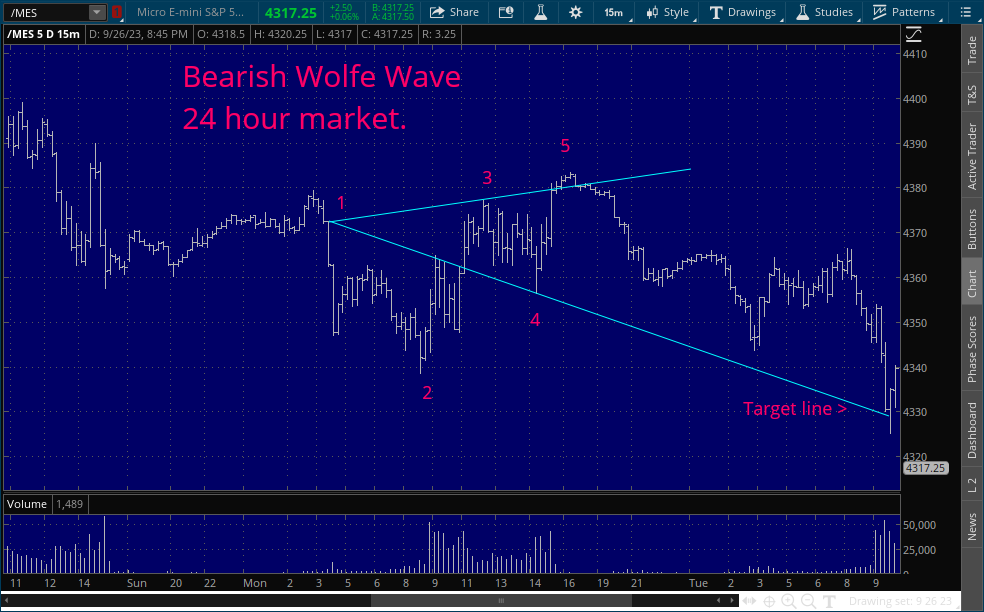

For those that like to trade the night market on a smaller scale (MES) this 15-minute nailed the target line, for the most part, while you were asleep.

Precise Wolfe Wave timing works 24/7.

Update: 9/18/23

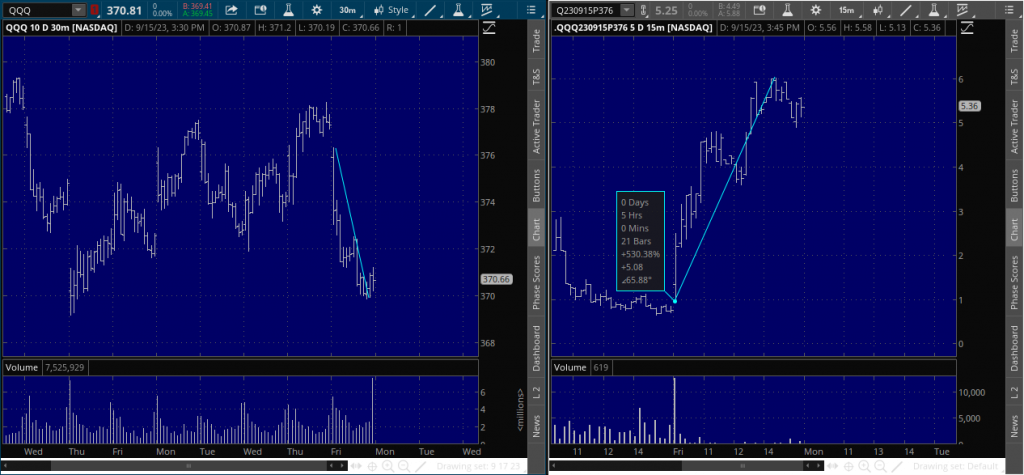

With the recent addition of zero days to expiration (0DTE), option trading gets even more exciting. Those with the Wolfe Wave knowledge can zero in on bets with precision to reap lottery like results.

On the two charts below the one on the left is a 30-minute of QQQ. My students could easily have recognized the bearish wave (not drawn). The chart on the right shows the price range of a put option. From bottom 1.02, to top 6.02, in just five hours on this “conservative” option choice.

QQQ with put option chart

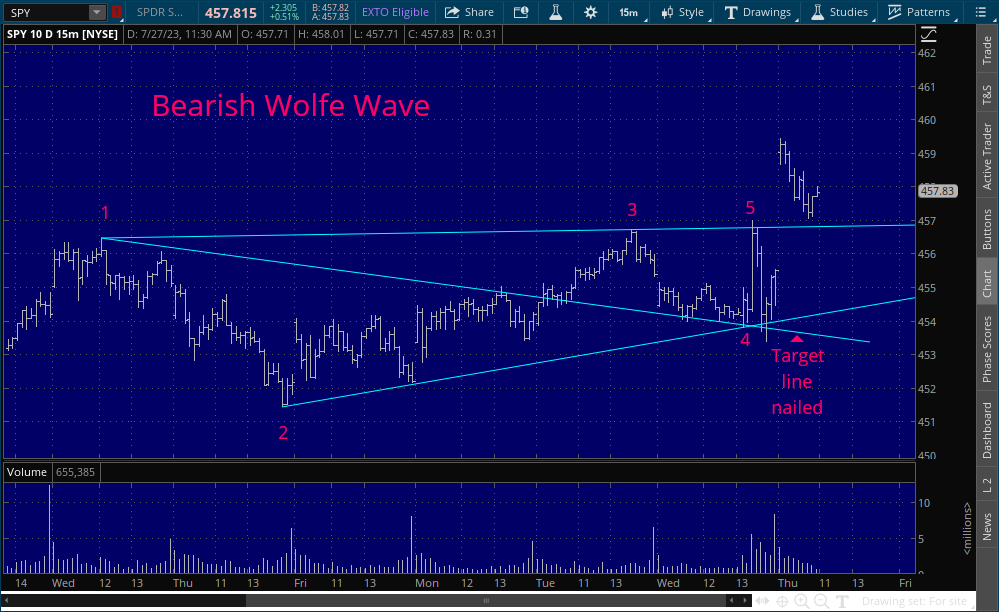

Update: 7/27/23

On FOMC days things happen fast but not chaotic as TV would have viewers believe. It is simply balance: a natural rhythm, a Wolfe Wave.

At the 4 point the Fed announced a ¼ rate increase. TV analysts’ debate. Wolfe Wave practioners salivate. They know that price is likely to rally to a 5 point then reverse with a vengeance to the target line.

This chart is a 15-minute of the SPY which is an ETF of the S&P. I plotted it on the SPY instead of the ES for easy comparison to a suitable SPY option.

– SEE MORE! –

Deep Space Hubble Telescope

So, what does this have to do with the stock market?

My ingredients are all natural. I use no preservatives or harmful additives: Indicators, oscillators, moving averages, or other junk.

I do use tools that were given to us by the Creator: Fibonacci spirals, waves, pendulum, vibrations and more.

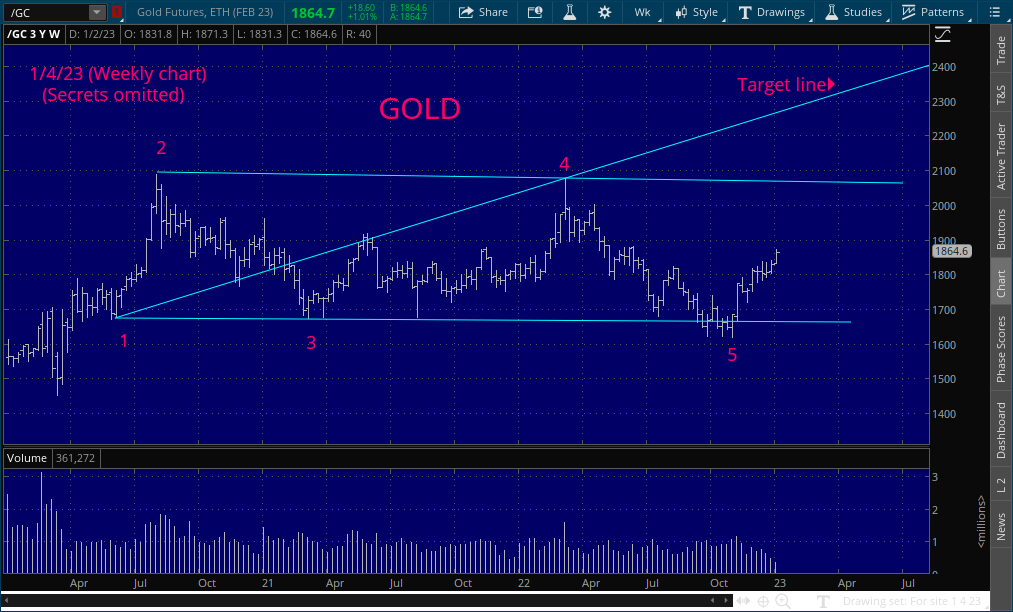

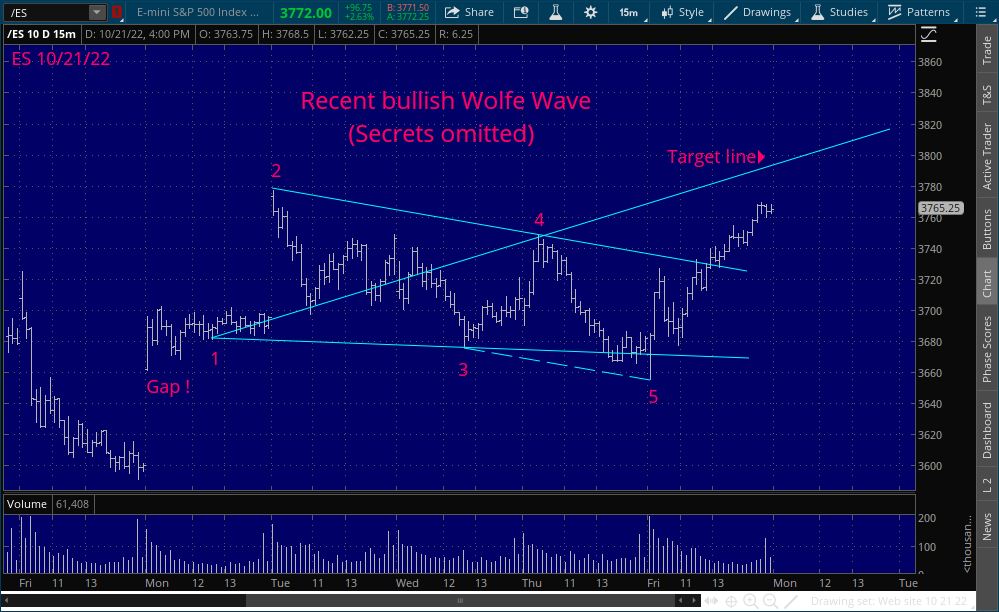

The current bullish wave should continue until price hits the target line or a bearish wave forms on a smaller time frame.

By taking my course you will learn the secrets and be able to scale down to as low as a 1-minute time frame to identify waves. Look too easy? Sure. Took me almost 50-years to perfect it.

The current bullish wave on the weekly time frame should continue until a bearish wave forms on a smaller time frame or the price hits the target line.

Did you know that identifying the correct time frame is the most critical component in chart analysis? Do you know that the time frame changes depending on whether you are looking for a bullish wave or a bearish wave?

This and much more is taught during my advanced lessons.

-

An Illustration Along with the Rules

Please note the odd sequence in counting, as you will see, it is necessary for the inductive analysis. By starting with a top we are assured of beginning our count on a new wave. (The reverse would apply for a bearish wave.) The 2 point is a top. The 3 point is the bottom of…

-

NEWS FLASH!!! The Wall Street Journal Corroborates Wolfe Wave methodology

WSJ Corroborates W.W. Methodology

-

Click Here if You Think the Government is Out to Get You

“Day trader goes berserk and kills television” “Survey shows that 99% of day traders lose money” “Scientist discovers possible link between day trading and acne” Ever wonder why day trading gets such bad press? Day trading is often compared to horse racing and casino gambling, yet horse racing and casino gambling don’t come under assault. …

-

A Wolfe Wave on a 1-minute S&P Chart

For those of you who consider a 5 minute chart “long-term,” the above 1 minute chart catches a “Picasso” in Wolfe Wave analysis. A perfect ETA and EPA. However in actual trading I advise against using the ETA as it just adds too many variables. Use the EPA to purchase a genuine Picasso.

-

Trading OEX Options off a 15-minute S&P Chart

As some traders already know, trading options is somewhat like that old game of “beat the clock.” In order to reap the huge reward, you not only have to be right on price direction, but you also must be correct on timing. The WolfeWave is the perfect tool for this. On the above S&P chart,…

-

A Wolfe Wave on a Daily Stock Chart

Pavlov got his dogs to salivate at the sound of a bell. So do WolfeWave practitioners. Opening Bell. Stock and option traders, could have had a beautiful measured move on the above daily chart of IBM. Without learning the “X-Ray Vision” so to speak–it took me almost 35 years–it would be almost impossible to find…

-

A Wolfe Wave on a Weekly Stock Chart

The “surprise” explosion in the price of gold did not come as a surprise to WolfeWave practitioners. As savvy investors know, the share prices of gold stocks often rise before the price of the metal. The above weekly chart of ASA has a beautiful WolfeWave that telegraphed the move weeks in advance when it hit…

-

Are You Afraid of the Dark?

Most traders are afraid to hold overnight. WolfeWave practitioners make money while they sleep. On the above chart, the “sweet zone” (5) was entered shortly before the close indicating a move up to the target line. Next day, at the opening, TV was telling traders that it was going to be a “great day” because…